Online forms are often incorrectly completed. We're missing required information. Penalties for violations can add up, and your organization could be at risk. About it all, employees hired by US employers after November 6, 1986, must have an i-9 form completed to verify both employment eligibility and identity. The i-9 form contains three separate and distinct sections: Section 1 Employee Information, Section 2 Employer Review and Verification, and Section 3 Rivarification and Rehires. Today, let's take a look at Sections 1 & 2, which address how to handle a typical new hire. Section 1 must be completed by the employee no later than the employee's first day of work. The employee attests that he or she is eligible to work in the United States, and you should review this section to ensure that the employee completes it properly. Section 2 must be completed within 3 business days of the date employment begins. It is the employer's responsibility to complete this section. The employee must present original, unexpired documents to establish employment eligibility and identity, which include one of the documents from List A or a document from both List B and List C. Keep in mind, it is an error to fill out all three columns or to fill in List A and B or A and C. Remember to fill in the employee start date and sign the form, including the date you actually reviewed the original documents. It is considered fraud to enter a false date when the form is complete. Place the form in the binder with all other active employees by nine salons. Do not place the i-9 form in the employee's individual personnel file. Stay tuned for our next video covering Section 3 re-verification and rehires.

Award-winning PDF software

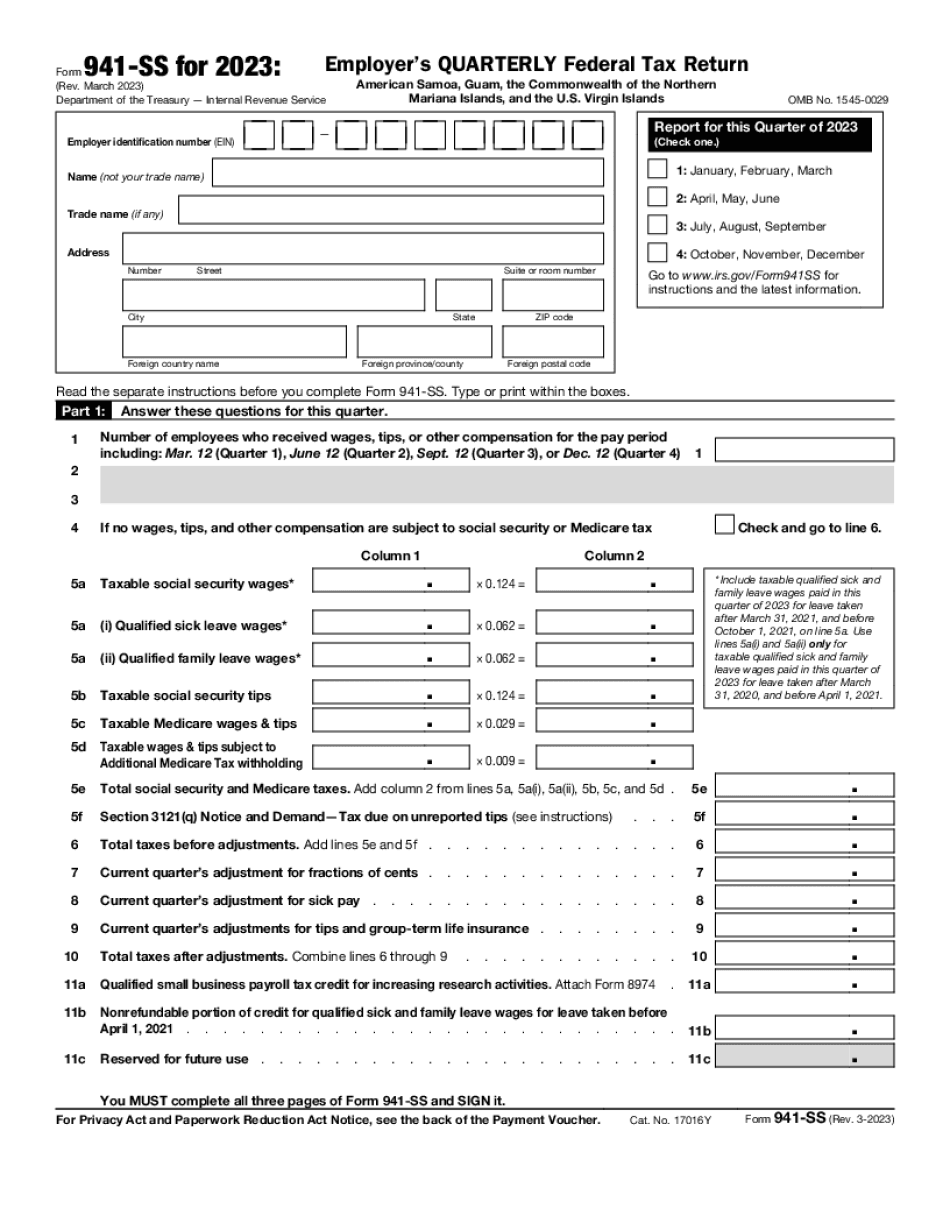

941-SS Form: What You Should Know

And Form 8109-B, How To Make The Federal Tax Deposit | Bamboo HR Where do I make the tax deposit I can only do a one time tax deposit, can't do it for more than 2 tax periods at a time but can do it every month, and I have to do this for all of my clients. It has to be done for all of my clients if their accounts are not all the same total amount. A tax payment needs to have to equal your total tax liability. So if you have a 10,000 debt for the year, then you need to pay tax on it. You can do 10 and a half times per tax period, but your total would be 110,000, and you would not be reimbursed until the entire balance is paid. You are able to do one time only tax deposits or a cumulative tax deposit. Cumulative Tax Deposits — To pay a total of tax to your company, you need to deposit the entire balance from that 10th consecutive tax period. Each time you deposit the amount you pay, you have an additional tax liability of the full amount. I have done 10-and 30-times deposits for my clients. For one time only deposits, you can also do 3-and 4-times and 5- and 6-times deposits. You can use a tax payment receipt for your deposit. Tax payment receipts also have the option to pay a refund directly to your bank account. What's in this form 8109-B? Taxes paid from April 15, 2016, to September 30, 2016. 40,637.88 Taxes paid from October 1, 2016, to March 31, 2017. 34,711.84 Taxes paid from May 1, 2017, to August 31, 2017. 16,890.60 Taxes paid from September 1, 2017, to November 30, 2017. 9,980.80 Where does Form 8109-B come from? The Form 8109-B form was created under Section 1081 of the Internal Revenue Code of 1986. This form was updated December 15, 1999, and April 25, 1997. Form 8109-B, Federal Tax Deposit Coupon; and Form 8109-C, FTD Address Change. Form and Instruction. F8109_burden.doc.pdf.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 941-SS, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 941-SS online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 941-SS by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 941-SS from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 941-SS