Award-winning PDF software

E-file form 941-ss online securely - taxbandits

Get your Copy of Form 8453-E, complete it using our system, apply it to your taxes, then submit through your e-file system. For the 2018 – 2021 tax years, the e-file form will be submitted using FAFSA, SSA's electronic filing system. More About E-file Form 941-SS Online E-file & E-file Form 941-SS Free 94x PIN/8453-EMP Ready to begin? We can help you begin your 941-SS preparation now. In 2017, the Form 941-SS e-file requirement started and was in effect for tax years before December 31, 2015. E-file Form 8453-E and complete Form 8453 and e-file Form 941-SS for 2018 and after The Form 941-SS free form for 2018 and after is now available. The 2018 – 2021 e-file, Schedule B, is required. If you wish to prepare your own tax return, there are more options.

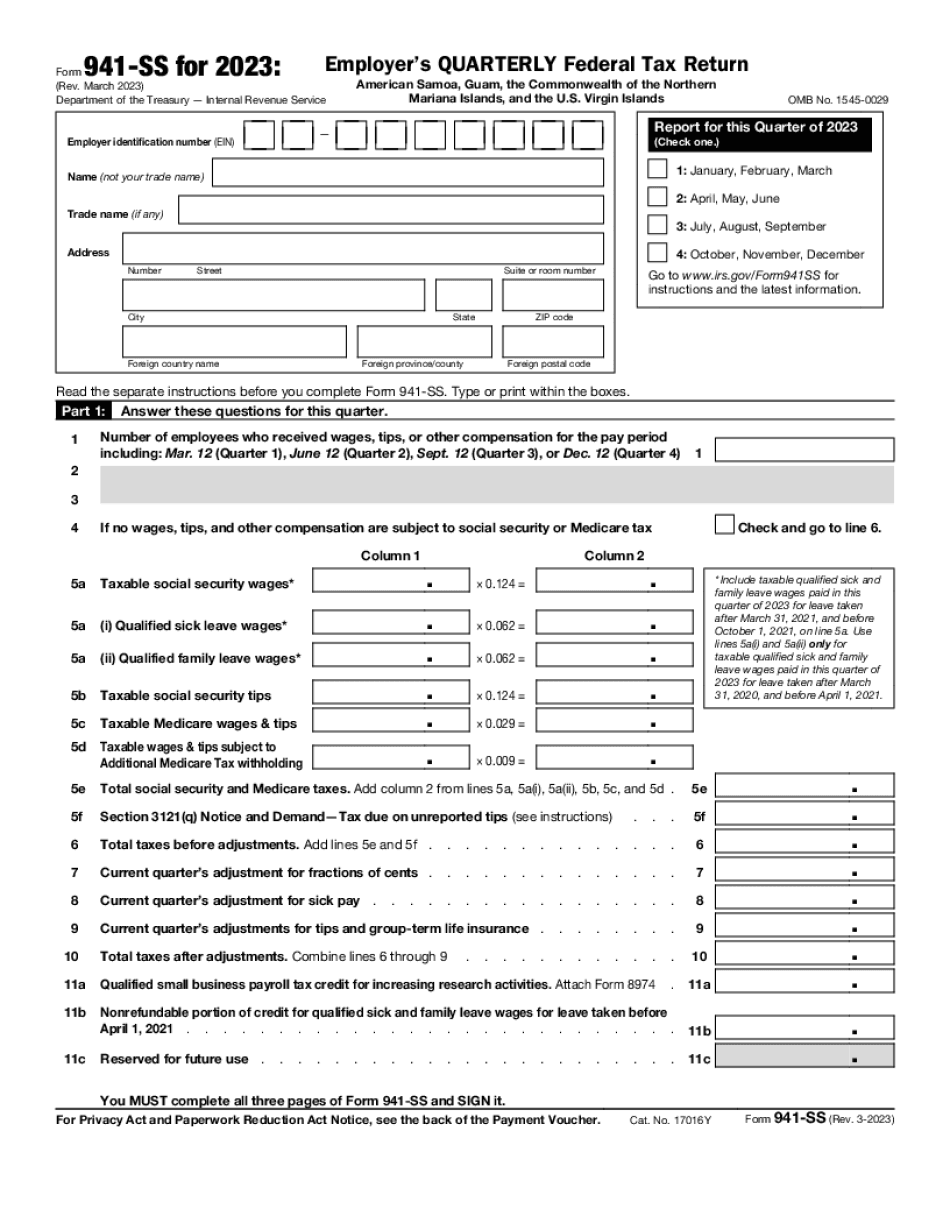

Form 941-ss - employer's quarterly federal tax return

Satisfactory” : “ taxpayer” (the “payer”) meets the definition of an individual as defined in Section 62(a) of the Internal Revenue Code. The United States is the only jurisdiction in the world with a “pass-through” corporate structure. SURPRISE! The “Satisfactory” rating will be reviewed and approved. No matter what — A “Satisfactory” rating will be assigned A “Good” rating will remain in effect until it is revoked as a result of further failure to provide the information requested. I suggest that we request a copy of this notice and let the IRS know that we think this is a awful idea. In the mean- time, we will take this opportunity to explain how we have taken our tax return filing process to the next level.

Instructions for form 941-ss - reginfo.gov

Tax Forms 941-SS; 1040. The IRS, Child Find for Residents and Visitors; Child Find for Residents; Child Find for Business. . Child Find: What We Do, Information Needed: Contact a local child protective service office for information on the local office, the department or the state or country on which the child was taken. . Contact a local child protective service office for information such as the name, address, and telephone numbers of the responsible public official. Contact: Child Find for Residents and Visitors. . Contact a local child protective service office for information about other agencies, such as the local police, the Department of Social Services, the office of the juvenile judge or the Child Adoption Center. Contact: Child Find for Residents or Businesses. Child Find: Residents: For residents, contact your local authorities as well as all agencies listed above. The number that will be provided to you by your.

Instructions for form 941-ss, employer's quarterly federal tax

Forms are also available on the website of the IRS: Federal Tax Return Information (IRS Form 941). The Form 941-SS can be used for all kinds of things, not just for employment taxes, such as: A business expense. Deductible business expenses. Income related to any business activity. You just need to complete it. You are supposed to give it to your employer, but for some reason, some employers haven't taken it. Furthermore, you are supposed to give the completed form to your employer by April 15 each year. That is the reason why you are reading this article now because I'm giving you the link to this form as well as my contact information for an accountant who can help you with the Form 941. Here is the form: And what I do is: 1. Complete the IRS Form 941. 2. Print off the following information: Your complete name Your complete address The full business name that you used to conduct your business.

form 941-ss , employer's quarterly federal tax return

The form is available online at and can be accessed from any internet enabled device.