Award-winning PDF software

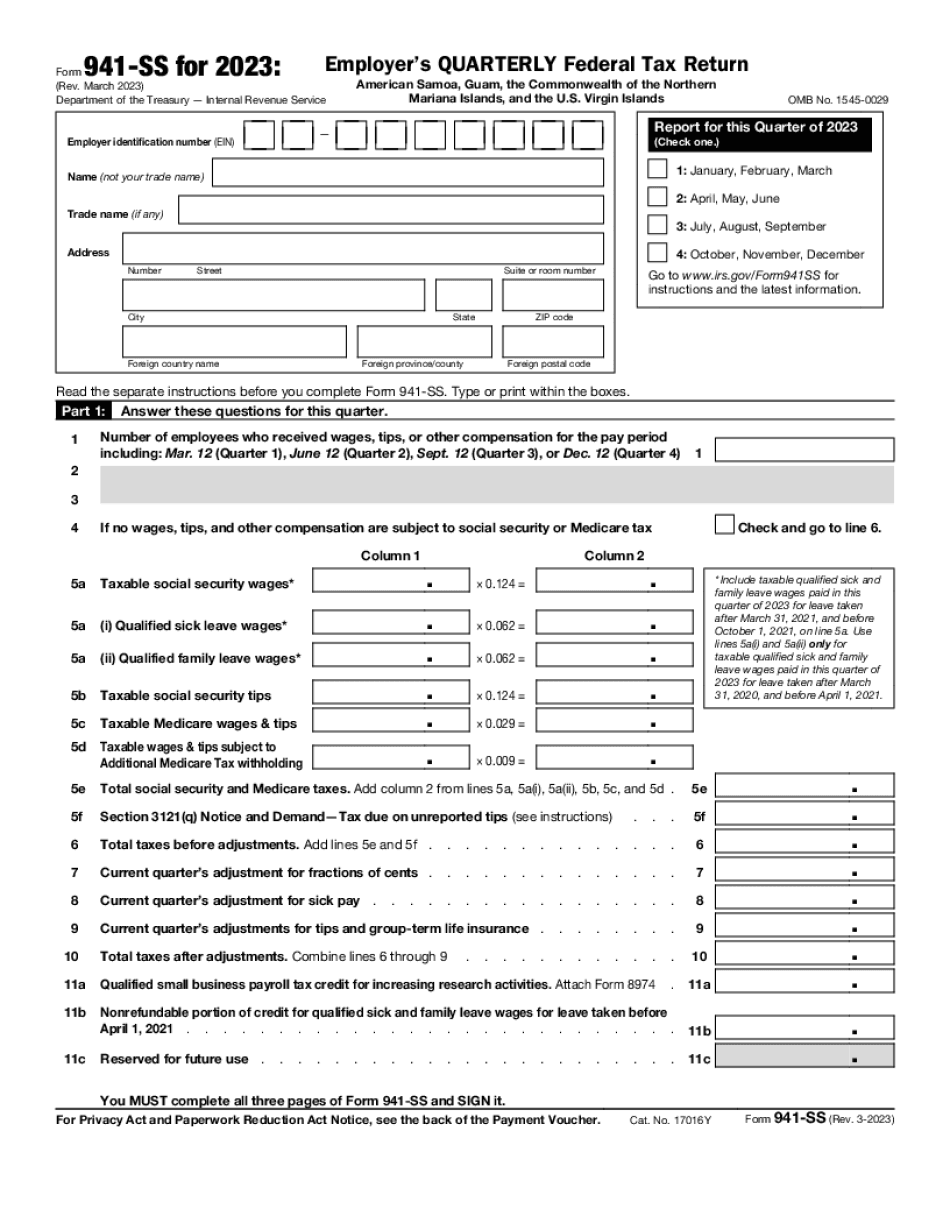

Form 941-SS for Kansas City Missouri: What You Should Know

This form is not a tax return. It provides information about employees who receive pay from certain public agencies and private firms in the City, including those performing public works. Form RD-110 is not required for the following individuals: • Employees who are paid with a salary from a public agency or private firm; • Employees who receive payments from a fund established in a county or city budget or ordinance; • Employees who receive funds from municipal bonds; • Employees who are employees of a corporation who is the public entity whose contract is being negotiated or whose contract will be performed or a contract between a public entity and its employees or labor organizations. You do not have a duty to report the income unless the gross compensation exceeds 1,000 or the value of the public benefits is 1,000 or more for a calendar quarter. In such situations, enter the “S” in column 3 on line 3. To get details on Form RD-110 for each employee, complete the Employee's Form RD-110 (CMO.gov) or Employer Form RD-110 (CMO.gov). If you are self-employed, you may complete the form and submit it to the Kansas City Area Council of United Way, 7800 West Kansas Ave, Suite A, Kansas City, MO 64 or call and ask for the Form RD-110 for each employee for the appropriate year. Employees who receive wages or benefits from public agencies, foundations or other organizations are not required to have these payments included on their Form RD-110. When do I need to attach Form RD-110? • All returns must report wages, compensation, taxes, and any other taxable returns for which income tax is payable. • All returns should indicate the number of times the employee received wages or compensation for his or her services. • All returns should be filed by the filing deadline. • Form RD-110 for employees who work outside of Kansas City, Missouri, should be submitted at the same time as Form 941-SS for employees working in Kansas City, Missouri. How to prepare Form RD-110 for employers: Employer's Form RD-110 (CMO.gov) (PDF file) is filed with the Missouri Department of Revenue's business registration office.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 941-SS for Kansas City Missouri, keep away from glitches and furnish it inside a timely method:

How to complete a Form 941-SS for Kansas City Missouri?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 941-SS for Kansas City Missouri aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 941-SS for Kansas City Missouri from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.