Award-winning PDF software

Form 941-SS for Tacoma Washington: What You Should Know

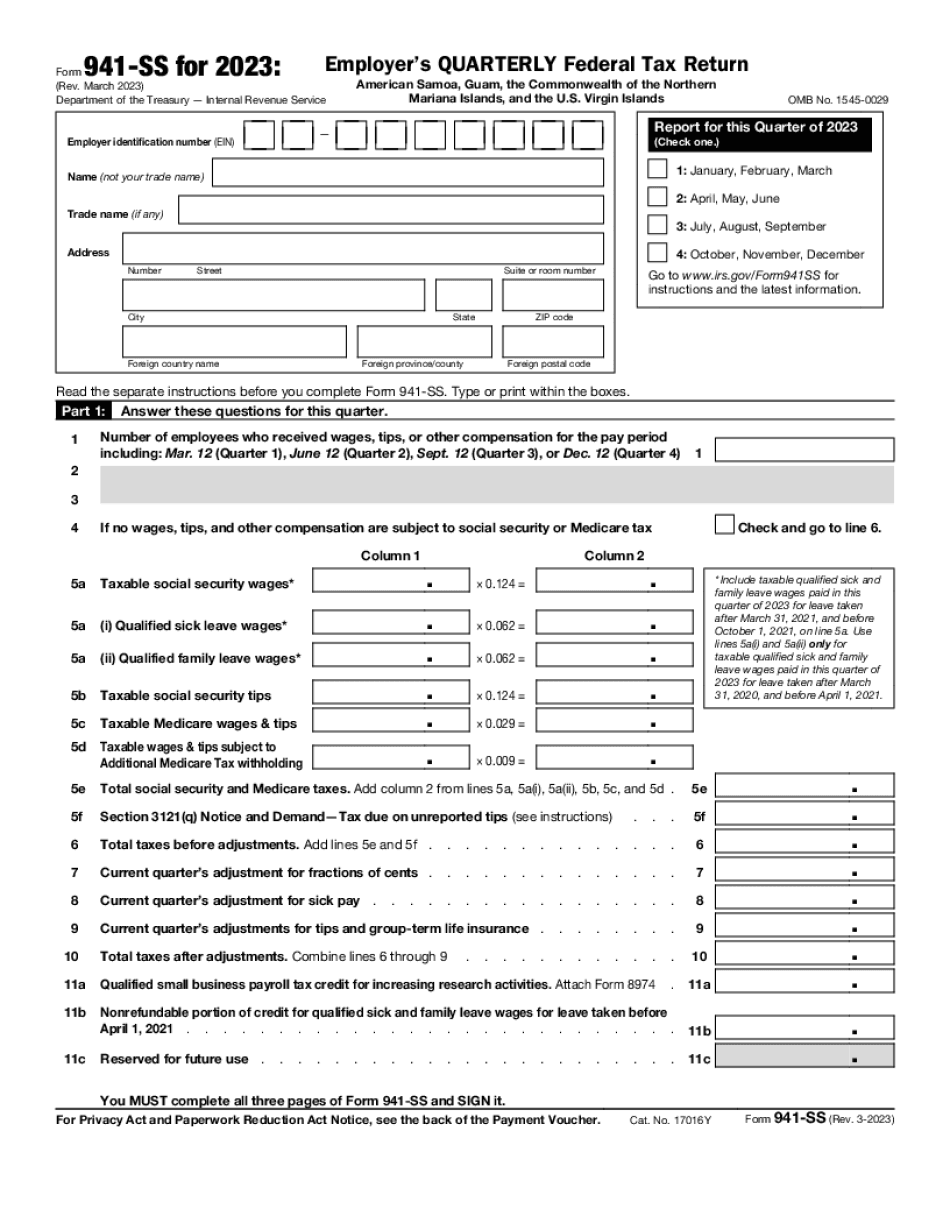

April 15, 2019 2nd Quarter — June 30, 2020 3rd Quarter — September 30, 2021 4th Quarter — December 31, 2022, What are Social Security and Medicare Tax Brackets? The standard income tax rate for 2025 is 3.4% while the Medicare tax rate for 2025 is 1.45%. Both rates can increase for 2025 and beyond. The Medicare tax brackets do not increase with each tax season for 2018, so this is your best source for year to year comparison. For information about the new Medicare Tax Rates for 2025 and the changes coming in 2019, see here. Note, if you are having trouble processing the return because of the income and filing status change, please see the guidance from the Social Security Administration. For the latest updates on the tax deadline, please see our tax deadlines page. A Note on the Tax Returns While these returns will generate tax, the tax return will not send a tax check to you. Please review your tax return carefully before sending it to the IRS. Tax returns sent to the IRS are the property of the taxpayer. The Internal Revenue Service (“IRS”) has no responsibility for the timely disposition of these returns. Please ensure that you fill out the applicable box(BS) as required by the information on your return. The IRS cannot address your question or concern. The IRS reserves the right, in its sole discretion, to determine whether a return is correct based on the information on the return or information on any return filed on behalf of the taxpayer. For any refund or other credit claim, please refer to. Please send your required documentation and information to: P.O. Box 688 PO Box 1488 Tacoma WA 98 IRS Address: PO Box 1488 IRS Street Address P.O. Box 688 T Note: You may also contact us and see our general information on filing a tax return for details on our procedures. If you have any questions, you should first see our online Tax Advice Guide. If you do have questions you can use the online chat or email address.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 941-SS for Tacoma Washington, keep away from glitches and furnish it inside a timely method:

How to complete a Form 941-SS for Tacoma Washington?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 941-SS for Tacoma Washington aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 941-SS for Tacoma Washington from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.