Award-winning PDF software

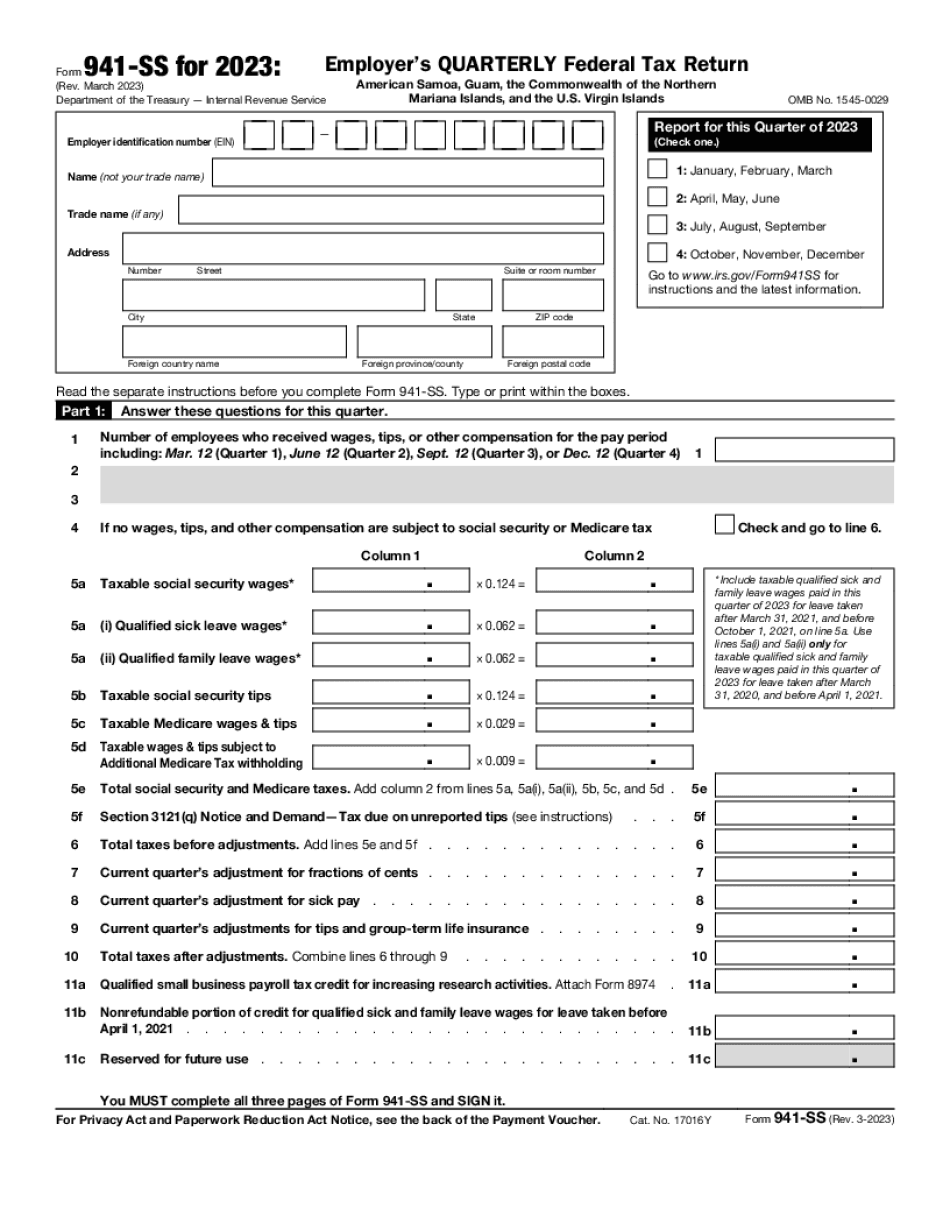

Form 941-SS Lakewood Colorado: What You Should Know

There are penalties for filing late. If you don't have all the data available when you file your form, you'll be penalized. For this type of problem, you probably should send a Form 4868 to the IRS, requesting the form. There is a good chance that the form will be processed. For most social security and Medicare tax problems, the quickest, easiest and best way to fix them is to make the entire Form 941, not a form for each pay day, but a separate check-out form so that the IRS is not able to use the original form for both tax seasons. You can also do the following to speed things up: Use Form 941-EZ on the online return to complete, sign and file, not Form 941; Don't file Form 941-EZ on paper so that you're not trying to file in different places such as on a different computer that shows your completed return. Use the online form with a credit card by completing it without typing your credit card information, such as the name, address and expiration date. Don't leave Form 941-SS with the IRS! There are many errors on the online Form 941 and in the Form 941-ES, and this can confuse the IRS. Send in a copy of the Form 941 and Form 941-ES, along with all documentation of the payroll taxes you owe, and the IRS may give you more credit for the taxes you paid if they can determine the errors in the form. Finance, Property Taxes, and Other Property Valuation. In most cases, you won't get a bill for unpaid property taxes. They can be paid with a late-payment penalty or refund, so plan to pay them in advance. What if we can't pay off all of our property taxes, or our property value has dropped? What should you do as soon as you know you owe more tax on property than the value of what it's currently worth, such as in the case of a big sale after a year-long foreclosure? Or if you sold it for more than you paid? A sale is considered taxable, but you may qualify for a tax refund. (If you can't pay the tax and the value of your property has dropped, you may still qualify for a refund if the tax is in the small-exemption bracket.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 941-SS Lakewood Colorado, keep away from glitches and furnish it inside a timely method:

How to complete a Form 941-SS Lakewood Colorado?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 941-SS Lakewood Colorado aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 941-SS Lakewood Colorado from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.