Award-winning PDF software

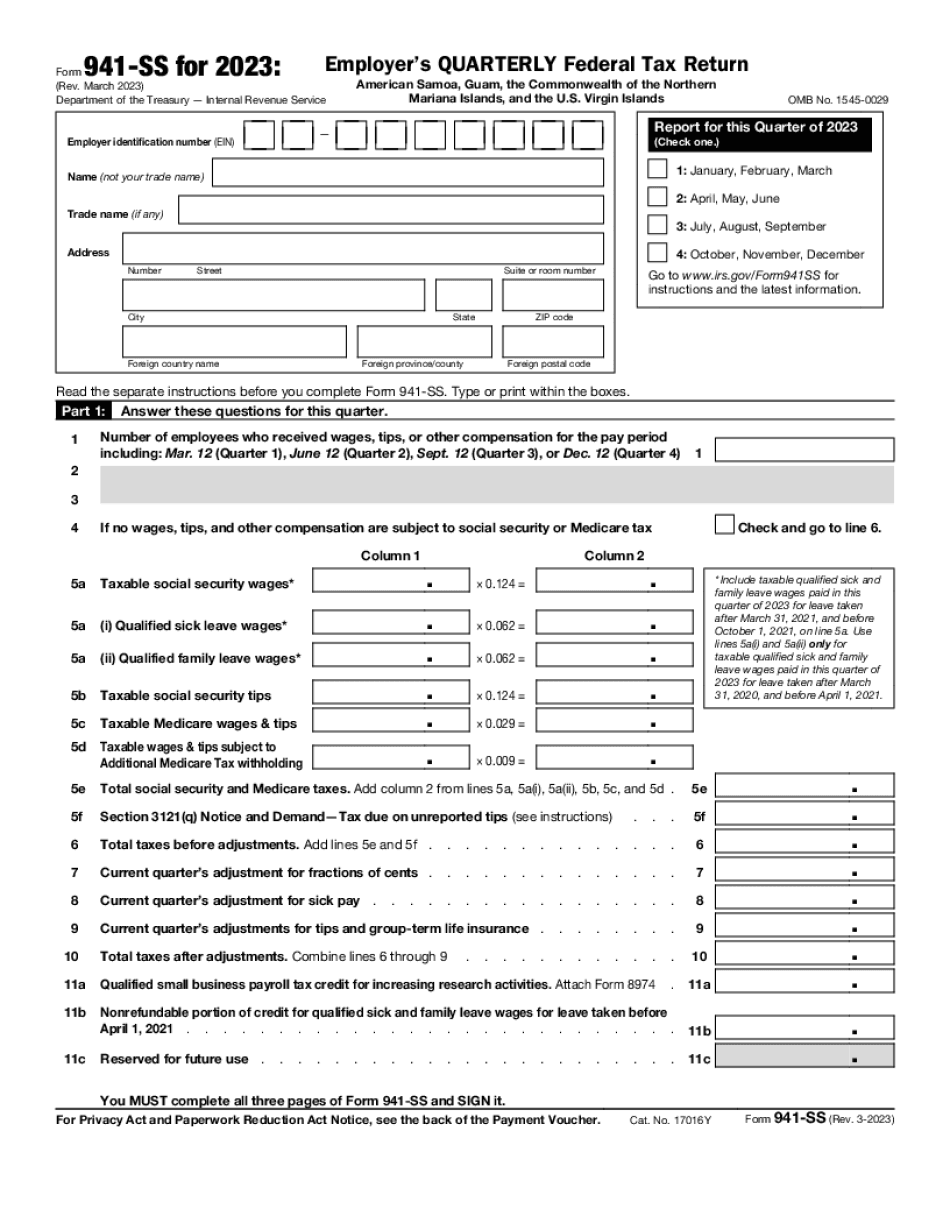

Form 941-SS online Bellevue Washington: What You Should Know

Taxpayers should have their federal income tax return due by April 15. Employer's Financial Reports — U.S. Department of Labor and Department of Treasury A report by the Department of Labor's Wage and Hour Division (Division of Wage and Hour) on business income tax liability includes Form W-2. This form includes Form section EIC-300, Employer's Annual Federal Unemployment (FTA) Tax Statement, to determine FTA unemployment tax. A report by the Department of the Treasury's Internal Revenue Service on U.S. corporations includes Form 1099-MISC. This form includes a Form section EIC-300, Employer's Annual Federal Unemployment (FTA) Tax Statement, to determine FTA unemployment tax. A report by the Department of Labor's Wage and Hour Division provides comprehensive information on employees' wages and expenses. A report on wages paid annually is available by calling the State of Alaska Department of Labor at. State Department of Labor U.S. Internal Revenue Service Other Tax Information You also may need to file a return of income if you receive the following federal financial aid benefits, including: Temporary Aid to Needy Families (TANK) The TANK state supplement is administered by the State Department of Social Services. See . Federal Well Grant The Federal Well Grant covers the cost of attending college at least half-time. The federal government pays most but not all the costs. The Well Grant is a federal program which funds tuition and related costs for low-income students. The Federal Well Grant covers the cost of attendance at community colleges, technical schools, and some colleges in Alaska. You may not receive the full amount. Also, a partial amount of the Well Grant may not be available if you receive federal student loan aid. Tuition and Fees at State or Community Colleges State colleges and state universities have a number of fees, which are part of their institutional costs. These fees fall into two general categories: student-related fees (such as parking, insurance, and other fees) and institutional costs (such as maintenance and instructional materials).

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 941-SS online Bellevue Washington, keep away from glitches and furnish it inside a timely method:

How to complete a Form 941-SS online Bellevue Washington?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 941-SS online Bellevue Washington aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 941-SS online Bellevue Washington from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.