Award-winning PDF software

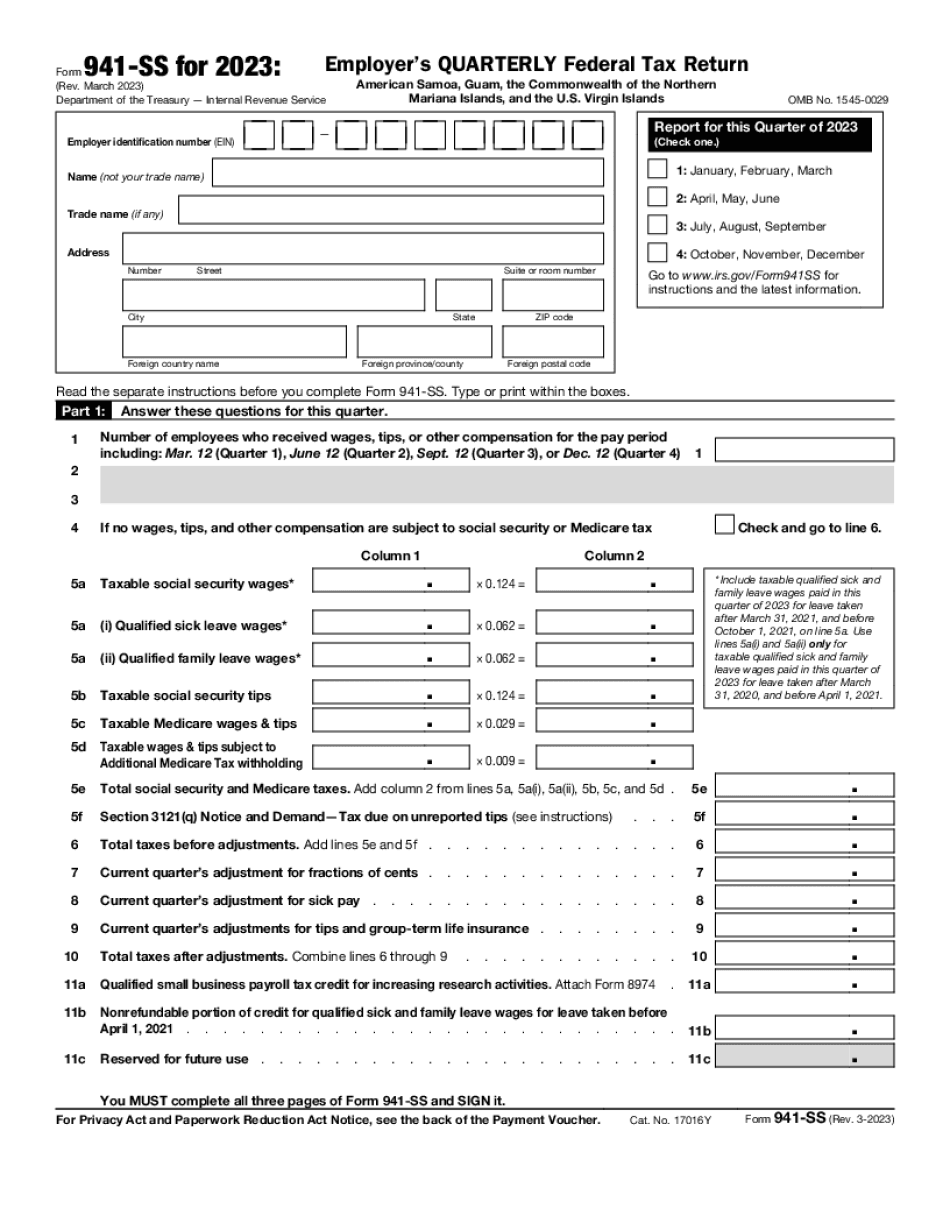

Printable Form 941-SS Broward Florida: What You Should Know

Mar 05, 2025 – 7500 Southwest Freeway, Palm Beach, Fl 33026 • • . The IRS is looking for volunteers to participate in this pilot project. It is a pilot program that will involve the submission of non-refundable personal income tax forms and the submission of non-refundable Social Security and Medicare taxes and associated fee's, as well as the payment of any and all fees and interest due for Form 941-SS in Florida. Volunteers will work between 7 a.m. to 3 p.m. daily throughout the three-phase one county and three-phase two metropolitan area counties of Broward, Miami-Dade, and Palm Beach counties. We will provide guidance on completing and submitting the Form 941-SS electronically and help you to become familiar with the electronic filing options available in tax season, and in the future, for filing your income taxes electronically. To volunteer at this event, please call and provide the following: Name of Taxpayer and Contact Information Number of tax years for which you are required to file Form 941-SS with the IRS. Name and address of business that prepares the income tax forms Date(s) of Employment with the business with the highest pay grade. Date(s) and reason for leaving the position. Reason for quitting your employment. Type of business, e.g., sole proprietorship or partnerships. Occupation if not an officer or employee of one or more taxable entities. Reason for quitting (e.g., work schedule changes, business concerns, etc.). Age of applicant if over 65. Education or training. Whether you believe you are a United States citizen under the Internal Revenue Code, as well as whether you are a legal resident of the United States. Your signature will be required as a condition to receiving any tax refund. Mar 30, 2025 – 1425 N. Florida AVE., Miami Beach, FL 33139 • • •. There are two different forms, a “non-resident” Form 941, and one for “resident” F941. We will be conducting a telephone “chatter” to determine which form is best for completing the form. When a good time to contact is determined based on the information provided, please provide us with that information, so we can help you through this activity.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 941-SS Broward Florida, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 941-SS Broward Florida?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 941-SS Broward Florida aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 941-SS Broward Florida from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.