Award-winning PDF software

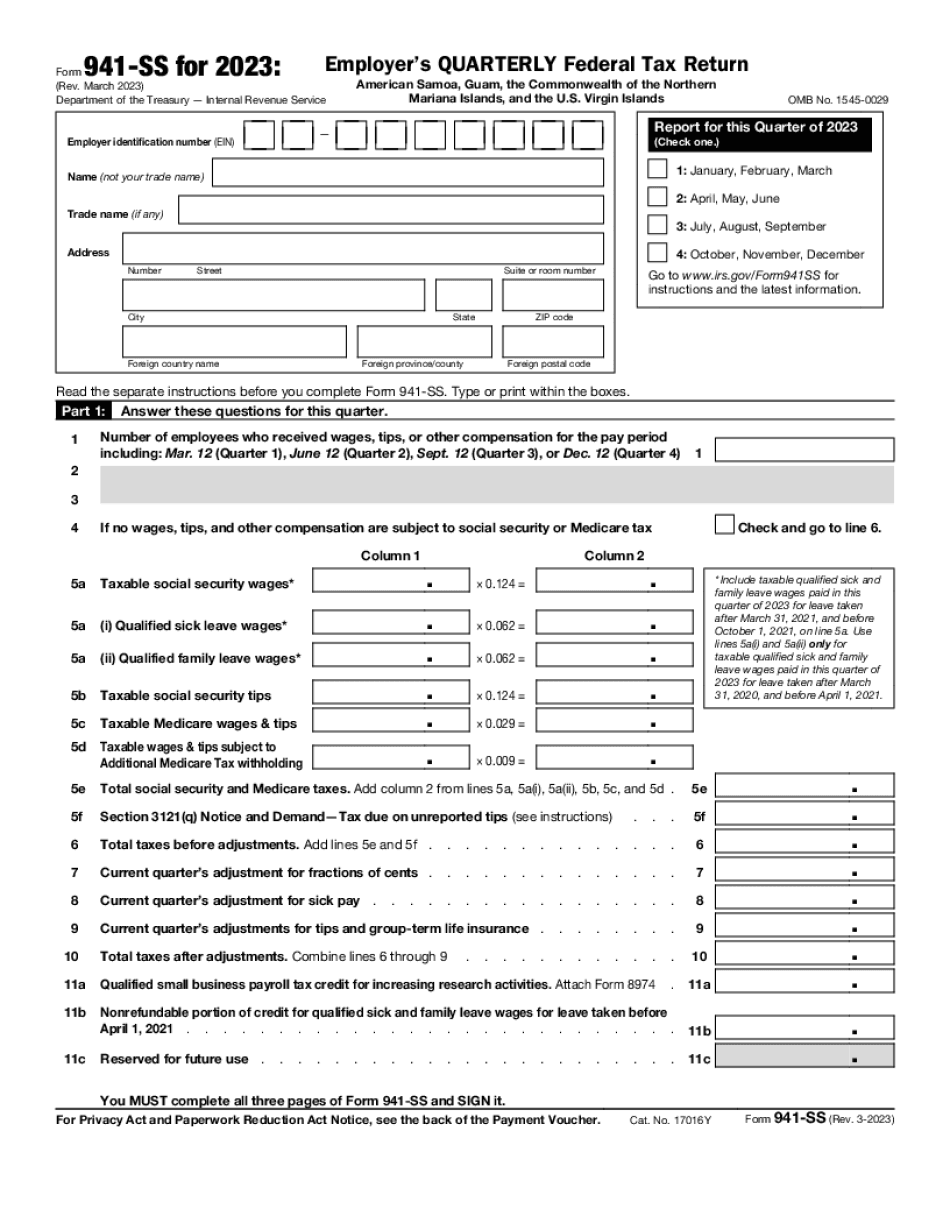

Form 941-SS online WV: What You Should Know

Wash. Rev. Stat. § 61A-8 (1991) — Wash. Rev. Stat. Tax Form 941, W-2 wage and tax statement, is an IRS publication for the public. It describes the tax treatment of noncitizen employees in this State and provides guidance on completing and filing such forms. Download Form 941 (2018) (PDF, 2.9 MB). Please send IRS Form 941 to the address listed below. Please do not send Form 941 to us electronically. We will not be able to help you with your forms, and we will not send you instructions for filing with the IRS. For information on filing, please see the Forms and Publications area in the IRS website. You can also file your IRS Form 941 online, using the Forms and Publications online filing system available at IRS.gov Wash. Rev. Stat. § 61A-8 (2011) — Wash. Rev. Stat. IRS Publication 948, United States Tax Guide for Freeborn Immigrants: United States A naturalized citizen is a person who was born in the United States, but is not a citizen at the time of application for naturalization. The United Nations Convention on the Rights of the Child makes it clear that the child is a natural child in all circumstances, although the individual child is not a natural child of the individual. It is well established that a United States person born abroad is a United States person in every respect; and that United States persons who are entitled to citizenship under the United States Constitution are natural born citizens. If you are an eligible noncitizen (and you want the IRS to look at your social security tax return) and you do not have an EIN, you need to tell the tax preparer who should receive your filed returns. IRS Tax Forms and Certifications Form SS-4 — SSN Change Form SS-5, SSN Change, for use by the IRS of an employee who wants her employer to change her SSN to match her new employer's Social Security Number. Form SS-5, SSN Change, is used to give the IRS the names of new SSNs for all current employees.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 941-SS online WV, keep away from glitches and furnish it inside a timely method:

How to complete a Form 941-SS online WV?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 941-SS online WV aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 941-SS online WV from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.