Award-winning PDF software

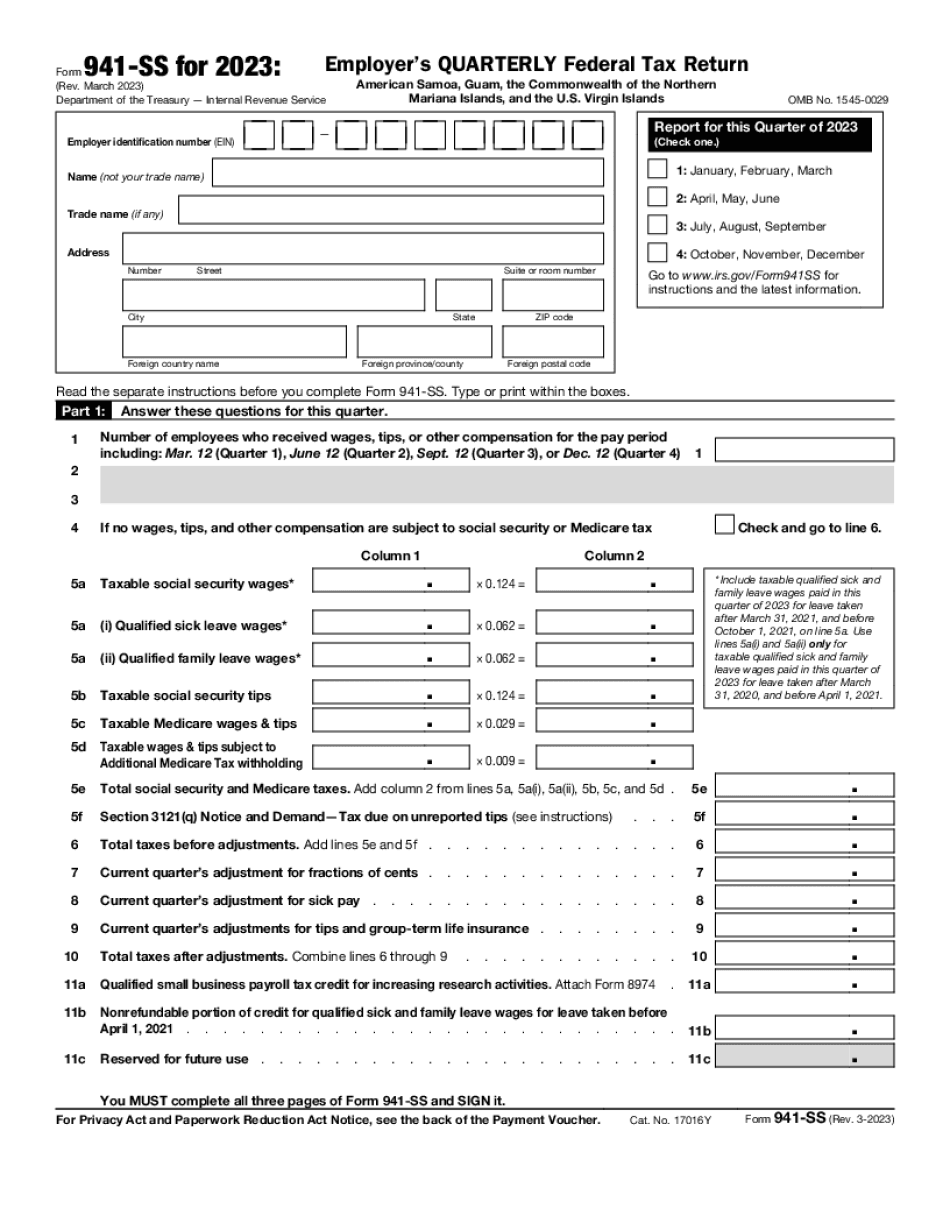

Form 941-SS Texas: What You Should Know

Form W-8BEN/ W-8BENL: UAH must include all payments received and any fees imposed because of the certification by Payee or Form 1095-A, Student Financial Responsibility and Educational Assistance Payment (STREP), if applicable. F. Publication 518, Tax Guide for Small Business, Instructions for Small Businesses: Form 8829, Instructions for Small Businesses (TAS): Form 2555, If your businesses are subject to taxation on a State or Federal income tax basis, you must submit Form 2555. Please refer to Publication 518, and the instructions. Instructions for Small Businesses (TAS) : Submit both forms and a valid and acceptable form of payment (check or money order) to the address noted on the following forms: 1) Form 2555 — Tax Return Certification of the Department of State 2) Form 2555-EZ-C — Form 2555-MISC — Certification of a Business that is subject to tax and does not receive payments from anyone other than the Government. B. Form 8829, Instructions for Businesses in Alabama — Notice of Federal Tax Noncompliance: Federal tax withholding are due from each Federal source of income for which Alabama will provide refunds. Each return should show a balance due of both tax withholding and refunds. The federal tax withholding is calculated as follows. Federal Taxes (Taxable) Alabama Tax Credits Alabama Tax Exemptions Alabama Income Tax Alabama Sales Tax California Property Tax Illinois Individual Income Tax Hawaii Corporate Income Tax Kentucky Individual Income Tax New Jersey Social Security Tax Rhode Island Corporation Income/Employment Tax South Carolina Sales Tax Tennessee Sales Tax Texas Unemployment Compensation Tax Utah Individual Income Tax Washington Individual Income Tax Wisconsin Individual Income Tax If your payment does not cover all of your tax liabilities, you must pay by February 10, 2016. All payments received in excess of the amount needed to correct your federal tax and Alabama tax liability must be returned to state by March 1. Failure to return payments could subject you to a civil penalty of up to 1,000 and the Department of Revenue to suspend your filing. It is at the discretion of the Dept. of Revenue not to give a refund if the taxpayer does not pay within 60 days as stated in the Alabama statutes.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 941-SS Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Form 941-SS Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 941-SS Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 941-SS Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.