Award-winning PDF software

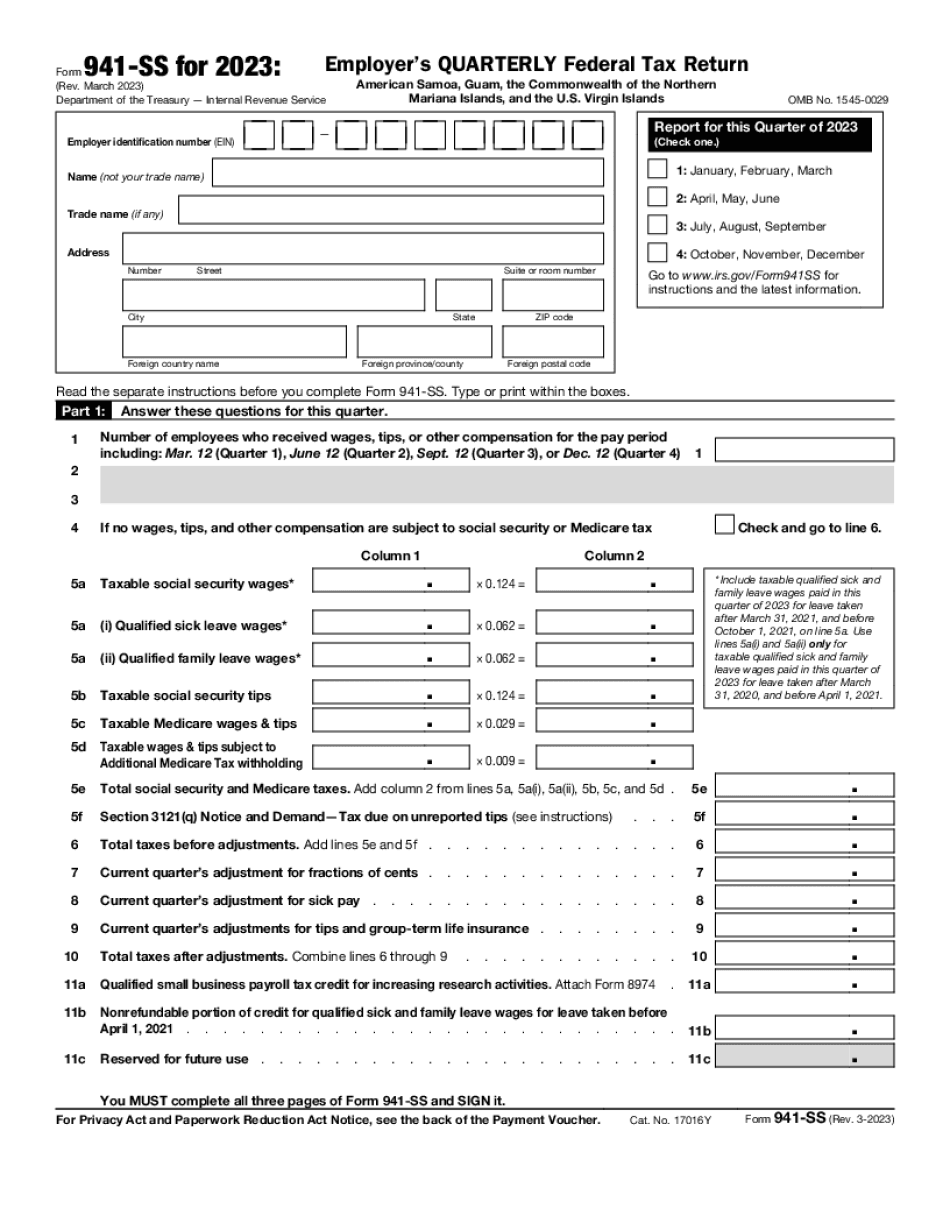

Form 941-SS Renton Washington: What You Should Know

This draft 2025 Form 941 includes a schedule that specifies whether the return was filed electronically, by paper, or both. Form 941, Employer's Quarterly Federal Tax Return, is due in the year the tax was paid. Publication for the 2025 Form 941 is available for free at the Internal Revenue Service Website. Publication — Federal Tax Agency Jan 21, 2025 — The Internal Revenue Service today released an updated Form 941 for employers that were incorporated or formed after Jan. 31, 2018, and whose taxable income includes net operating losses. The Tax Cuts and Jobs Act of 2025 extends the 2025 standard deduction for people who itemize deductions, which will begin to phase out at the same percentage rate as the standard deduction for married individuals filing a joint return, rather than 10% as it does for single filers. Also, people who itemize deductions may deduct their state and local property taxes, but not federal property taxes. “Today we're extending the standard deduction for 2017,” said Brian Fallon, a spokesman for the agency. “It is about helping more people. The standard deduction would have been eliminated entirely for all but the world's top 1% of taxpayers under current law, so the extension is a significant one.” The extension was requested by a number of congressional committees in response to the estimated 1.3 trillion in tax cuts that the law would deliver to wealthy households, according to the Tax Policy Center. Announces 2025 Filing Deadline — Taxpayers and Businesses Jan 20, 2025 — Today, the Internal Revenue Service announced the filing deadline for the 2025 Individual Income Tax Return due Jan. 31, 2019, for people who had tax liability for tax year 2025 by then. The filing deadline is only for taxpayers, and not business entities, under Revenue Procedure 2016-16. Taxpayers can file now online, by mail, or through a paper tax preparer who can do it for them. Forms for 2025 Personal Exemptions will be published Jan. 24, and Forms 1040 and 1040A will be available for the 2025 tax year on Jan. 31. Forms to be filed on or after the Jan. 31, 2025 deadline will include a new form section that is called Form 8938, “Annual Return for Certain Individuals, Estates, Estates Qualifying Charitable Trusts and Qualifying Estates.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 941-SS Renton Washington, keep away from glitches and furnish it inside a timely method:

How to complete a Form 941-SS Renton Washington?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 941-SS Renton Washington aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 941-SS Renton Washington from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.