Award-winning PDF software

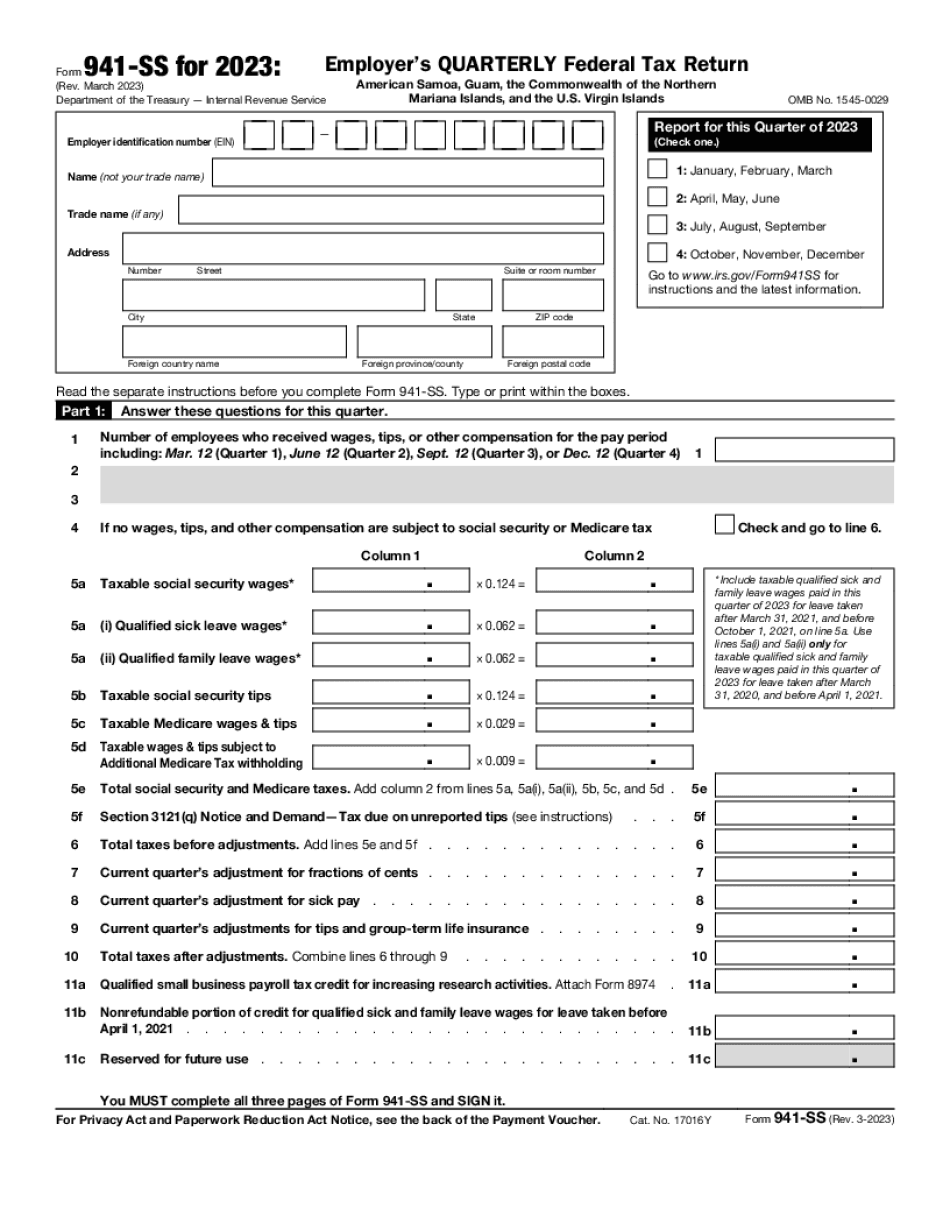

Form 941-SS for Maryland: What You Should Know

California 941 must be submitted to California Tax Department (TDR) at address below: Department of Finance Attn: Business Licensing P.O. Box 92535 Sacramento CA 95825 Washington DC 941 must be submitted to DL (State Depository) at the mailing address below: Department of Treasury Attn: DL P.O. Box 94105 Sacramento CA 95833 New York 941 must be submitted to IRS, New York Department of Taxation & Finance, PO Box New York State Department of Taxation and Finance 5 State Street, Room 515 Albany NY12210 (Office Hours: 9:00 AM — 3:00 PM, Monday – Friday) [Address] (New York Tax Department (DL) Business and Tax Compliance Division Office Address; 5 State Street Albany NY12210 (Office Hours: 9:00 AM — 3:00 PM, Monday – Friday) [Address] Wisconsin 941 must be submitted to WI Department of Revenue (FOR) at the mailing address below: Department of State Wis. Department of Revenue P.O. Box 1150 Madison WI 53 For more information about submitting form 941 | 941-SS & 945(i) please refer to: Business (IRS) Form 945-S (Rev. May 25, 2018) If you believe your business is being taxed incorrectly, you may be able to correct the situation in a short period of time. The IRS is currently making a policy change in recognition of the growing number of tax disputes. In the next several weeks, tax professional's should receive a letter regarding the new policy. It would be very beneficial for you to read this letter, and to follow the direction provided below. A brief synopsis of the changes that will be effected, and what to DO after being contacted by the IRS. Business (IRS) Form 945-S — Notice to Self-Employed Individual and Business (IRS) (P.O. Box 71256) In compliance with the Revenue Procedure Act (RPA) of 1978, the United States Internal Revenue Service is changing the way it handles certain claims of tax liability involving self-employment.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 941-SS for Maryland, keep away from glitches and furnish it inside a timely method:

How to complete a Form 941-SS for Maryland?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 941-SS for Maryland aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 941-SS for Maryland from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.